Ola ride-hailing biz falls 11% in FY24, turns EBITDA profitable

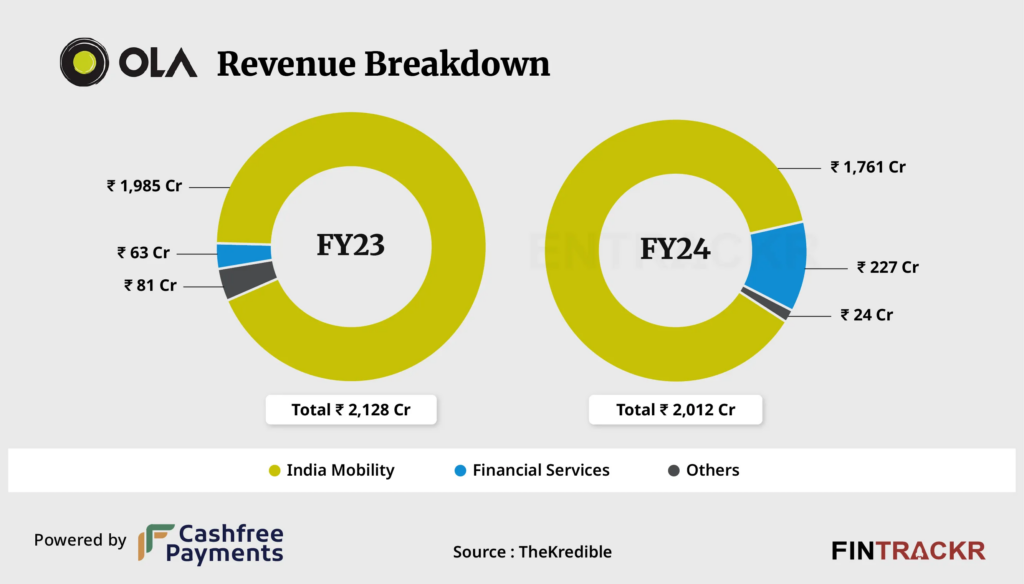

Ola recorded a 5.5% year-on-year decline in revenue for the fiscal year ending March 2024, indicating no growth during the period. Despite the revenue drop, the firm managed to turn EBITDA profitable, driven by cost reductions in employee benefits and communication costs. Ola’s revenue from operations declined 5.5% to Rs 2,012 crore in FY24 from Rs 2,128 crore in FY23, its consolidated financial statements sourced from the Registrar of Companies (RoC) show.

Income from Ola's ride-hailing business contributed 87.5% of the total operating revenue in FY24, but it decreased by 11.3% to Rs 1,761 crore, down from Rs 1,985 crore in FY23. Ola's financial services business recorded a 3.6X growth in FY24, with revenue increasing to Rs 227 crore from Rs 63 crore in FY23. This segment focuses on selling insurance policies and providing financing services for vehicle purchases, primarily for Ola Electric.

The company also received Rs 192 crore primarily from interest on deposits that took its total income to Rs 2,204 crore for FY24, from Rs 2,277 crore for FY23. For Ola's ride-sharing company, mobility costs accounted for 28.8% of total costs. Owing to lesser mobility, the costs reduced by 15.2% to Rs 607 crore during FY24. Its staff welfare costs decreased by 42% to Rs 334 crore and telephone and post charges declined 28% to Rs 280 crore. Unexpectedly, its ad expenditure increased 2.6X to Rs 107 crore during FY24. Its law, rent, and other overheads pushed the total expense to Rs 2,107 crore in FY24 from Rs 2,517 crore in FY23.

Observation:

We have omitted the expense of allowance for impairment of goodwill and other intangible assets from the computation of losses which was Rs 319 crore and 149 crore in FY24 and FY23, respectively, as it is non-cash in nature. Despite the decline in its ride-hailing business, Ola effectively controlled its costs, resulting in a loss of Rs 10 crore in FY24, compared to a Rs 623 crore loss in FY23. Notably, the firm becomes EBITDA profitable during the previous fiscal year. On a unit level, the company spent Re 0.89 to earn a rupee of operating revenue during the fiscal year. In August 2024, Bhavish Aggarwal made the announcement that Ola Cabs would be renamed to Ola Consumer, consolidating its financial services, cloud kitchens, and electric logistics under one umbrella.

The company is also getting closer to its initial public offering (IPO). As per reports, Ola's parent entity, ANI Technologies Private Limited, has convened an extraordinary general meeting (EGM) on November 14, 2024, to consider issues pertaining to the IPO. Yet, Ola has not made an official statement regarding the timeline for its public listing. In August 2024, Aggarwal stated that Ola Cabs would be renamed Ola Consumer, bringing financial services, cloud kitchens, and electric logistics under a single roof. The firm has also suffered valuation markdowns from its investors over the past few years. In August 2024, Vanguard revised Ola's valuation to around $2 billion. Previously, the investment advisor had cut the valuation to $1.88 billion as of November 30, 2023. This is a steep fall from 2021 when Ola was valued at $7.3 billion.